Thailand, often hailed as “the Detroit of Asia,” has been a formidable force in the global automotive manufacturing landscape for decades. With a rich history and strategic policies, the country has emerged as a powerhouse, boasting the largest automotive industry in Southeast Asia and ranking 10th globally as of 2019. In this blog, we delve into the thriving automotive parts supply industry in Thailand, exploring key factors that contribute to its success, government policies, and its crucial role on the global stage.

The Automotive Industry Landscape in Thailand:

The Automotive Industry Landscape in Thailand:

Thailand’s automotive industry stands tall as the largest in Southeast Asia, producing over two million vehicles annually, including passenger cars and pickup trucks. The industry’s success is attributed to its collaboration with foreign producers, predominantly American, Japanese, and Chinese companies. Notably, GM has made substantial investments, exceeding $2 billion, in manufacturing facilities located in Rayong.

The Thai government plays a pivotal role in fostering a conducive environment for the automotive sector. Well-defined policy directives attract foreign investment, promoting the development of the industry. Land ownership rights for foreign investors, streamlined visa processes, and enticing tax incentives, such as an eight-year corporate income tax exemption, incentivize companies to establish operations in Thailand.

Additionally, the Thai automotive industry strategically utilizes the ASEAN Free Trade Area (AFTA) to expand its market reach for various products. This regional cooperation allows for preferential trade agreements, facilitating the export of vehicles and components to neighboring countries.

Parts Manufacturing Exports: A Significant Economic Contributor:

Automotive parts have emerged as top export items, contributing significantly to Thailand’s economy. In 2023, the sector earned a staggering $15.6 billion. Major export markets include the USA, Japan, Southeast Asia, and Australia, showcasing the global competitiveness of Thai-made auto parts. With a stable economic foundation and abundant resources, Thailand positions itself as a significant player in the global automotive component manufacturing landscape.

Thailand boasts approximately 2,200 auto parts and accessories manufacturers, ensuring high-quality, on-time production that translates into profitability. These manufacturers have evolved into a global industry, exporting products to over 100 countries. Among these, nearly 500 are foreign-owned firms catering to the original equipment manufacturers (OEM) market segment.

Eastern Economic Corridor (EEC): A Vision for the Future:

The Eastern Economic Corridor Office of Thailand (EECO) is a vital public agency aiming to encourage investment, uplift innovation, and advance technology in Thailand. It is a business facilitator that can be utilized and add value across the entire lifecycle of industry related programs to help ensure strategic investments by automotive part manufacturers are successful.

The EEC is a testament to the country’s commitment to further developing its industrial epicenter. Through various trade and development initiatives, including tax breaks, fast-track visas, and extended land rental options, Thailand aims to solidify its position in the global automotive arena.

Geographical and Infrastructure Advantages:

Thailand’s excellent strategic geographic location is positioned right in the center of Southeast Asia. Due to its close proximity to important markets like China and India, the nation has become a popular destination for international investors hoping to profit from the region’s expanding marketplaces. Cities like Hong Kong and Singapore are only a short flight away.

Thailand’s growth as a regional commerce hub has also been significantly influenced by its location at the intersection of important sea routes. Thailand has a well-developed transportation infrastructure, including modern highways, ports, and airports. This makes it easy for automotive suppliers to transport goods and services both domestically and internationally. Ports like Laem Chabang and Map Ta Phut, which rank among the busiest in Southeast Asia, have played a crucial role in the development of the nation’s export-focused economy.

Bangkok offers a top-class airport, and the city welcomes more visitors than any other city in the world. In terms of telecommunications, Thailand has a highly advanced and reliable network, with 4G and 5G coverage available in most areas. This makes it easier for businesses to communicate and stay connected with their partners and customers both domestically and internationally.

Labor:

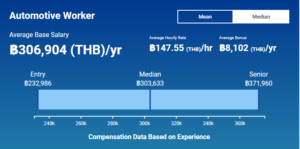

The average automotive worker gross annual salary in Pattaya, Thailand is $8,606 USD (฿306,904) or an equivalent hourly rate of $4.15 (฿148). In addition, they earn an average bonus of $227 (฿8,102). Salary estimates based on salary survey data collected directly from employers and anonymous employees in Pattaya, Thailand. An entry level automotive worker (1-3 years of experience) earns an average annual salary of $6,534 (฿232,986). On the other end, a senior level automotive worker (8+ years of experience) earns an average salary of $10,431 (฿371,960) (Data powered by ERI’s Salary Expert Database).

Conclusion:

Conclusion:

Thailand’s automotive parts supplier industry is a dynamic force that has played a pivotal role in establishing the country as a prominent player in the global automotive landscape. With strategic government policies, geographical advantages, a skilled labor force, and a commitment to innovation, Thailand continues to drive growth in the automotive sector. As the industry evolves, the Thai Eastern Economic Corridor sets the stage for future developments, ensuring that Thailand remains a key player in the automotive parts supply chain.

For more information, visit: Thai Automotive Industry Association (TAIA), https://www.taia.or.th, or Eastern Economic Corridor Office of Thailand, https://www.eeco.or.th/en

It is our hope that you find this industry insight helpful. Please feel free to join the conversation by visiting https://www.lai-project.com/news.